In the wake of increasing scrutiny on Prime Minister Kishida’s cabinet, it appears that an increase in consumption tax may be looming in Japan’s future. Interestingly, the term ‘消費税’ (shouhizei) in Japanese translates to two different terms in English: ‘Sales Tax’ and ‘Consumption Tax’. Despite common belief among Japanese citizens, finance officials, and even accounting experts that it’s a consumption tax, the reality is that Japan’s ‘消費税’ functions more like a sales tax.

A sales tax, unlike a consumption tax, is borne by businesses, not consumers. This means that Japan’s consumption tax is not merely a pass-through charge as widely believed. When companies prepare their tax filings, salaries paid to employees cannot be deducted from this tax, which limits the ability of businesses to increase wages.

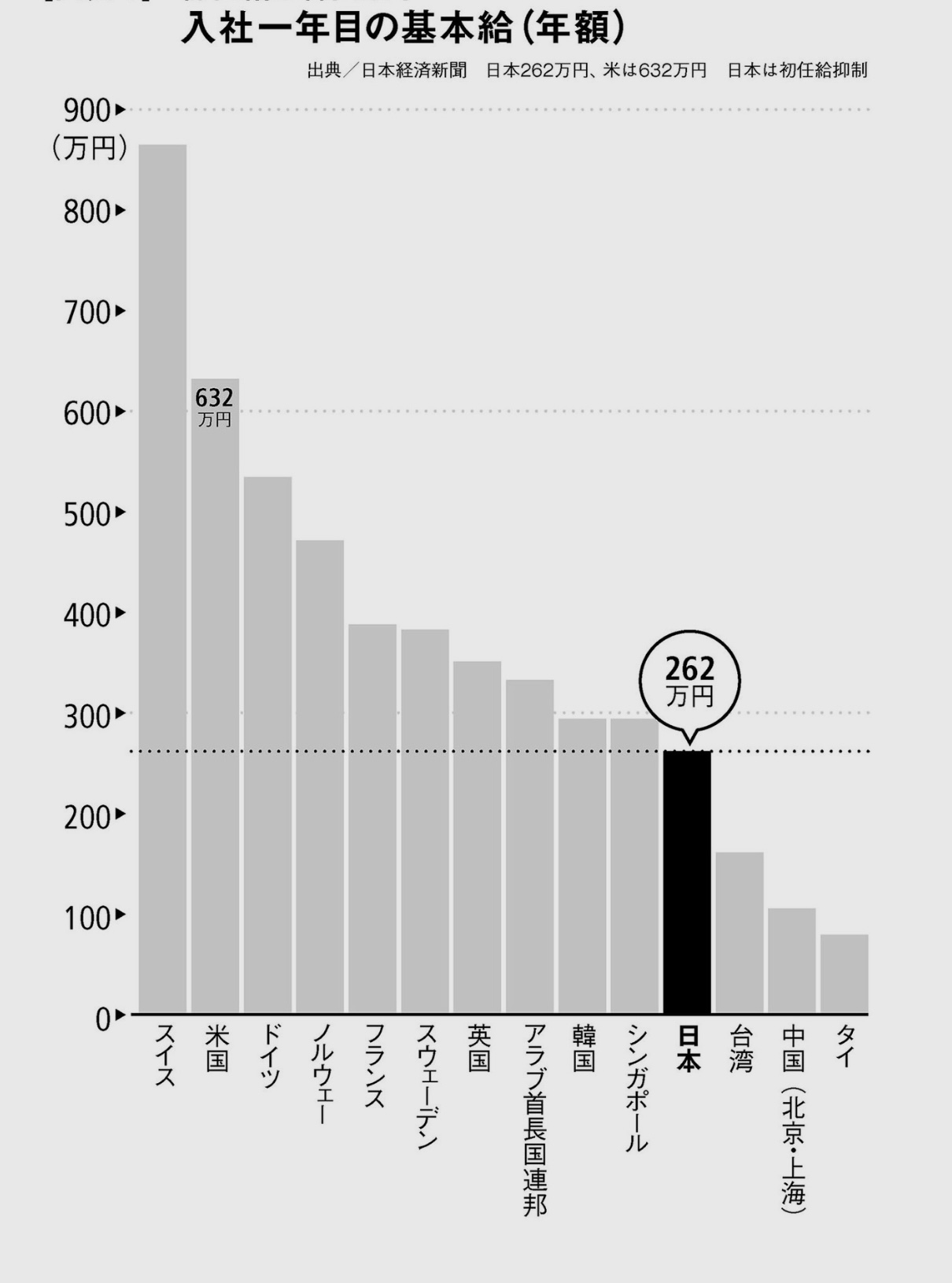

Consequently, salaries in Japanese companies have not seen significant increases over the past 30 years. With the current political climate, it’s unlikely that this will change in the near future, largely due to a fundamental misunderstanding of the accounting principles behind the consumption tax. This misunderstanding and the resultant fiscal policies could continue to stifle wage growth and impact the Japanese economy.

#JapanEconomy #TaxPolicy #ConsumptionTax #SalesTax #JapanesePolitics #BusinessImpact #EconomicGrowth #FiscalPolicy #WageStagnation #FinancialAwareness