As the year draws to a close, Europe enters the Christmas holiday, while in Japan, December is known as “Shiwasu” (師走), literally translating to ‘the month of running around.’ It’s a busy time for everyone, including business owners like myself, who are inclined to generously reward their employees for a year of hard work.

However, the Japanese system of consumption tax and social insurance premiums imposes certain constraints on this goodwill gesture.

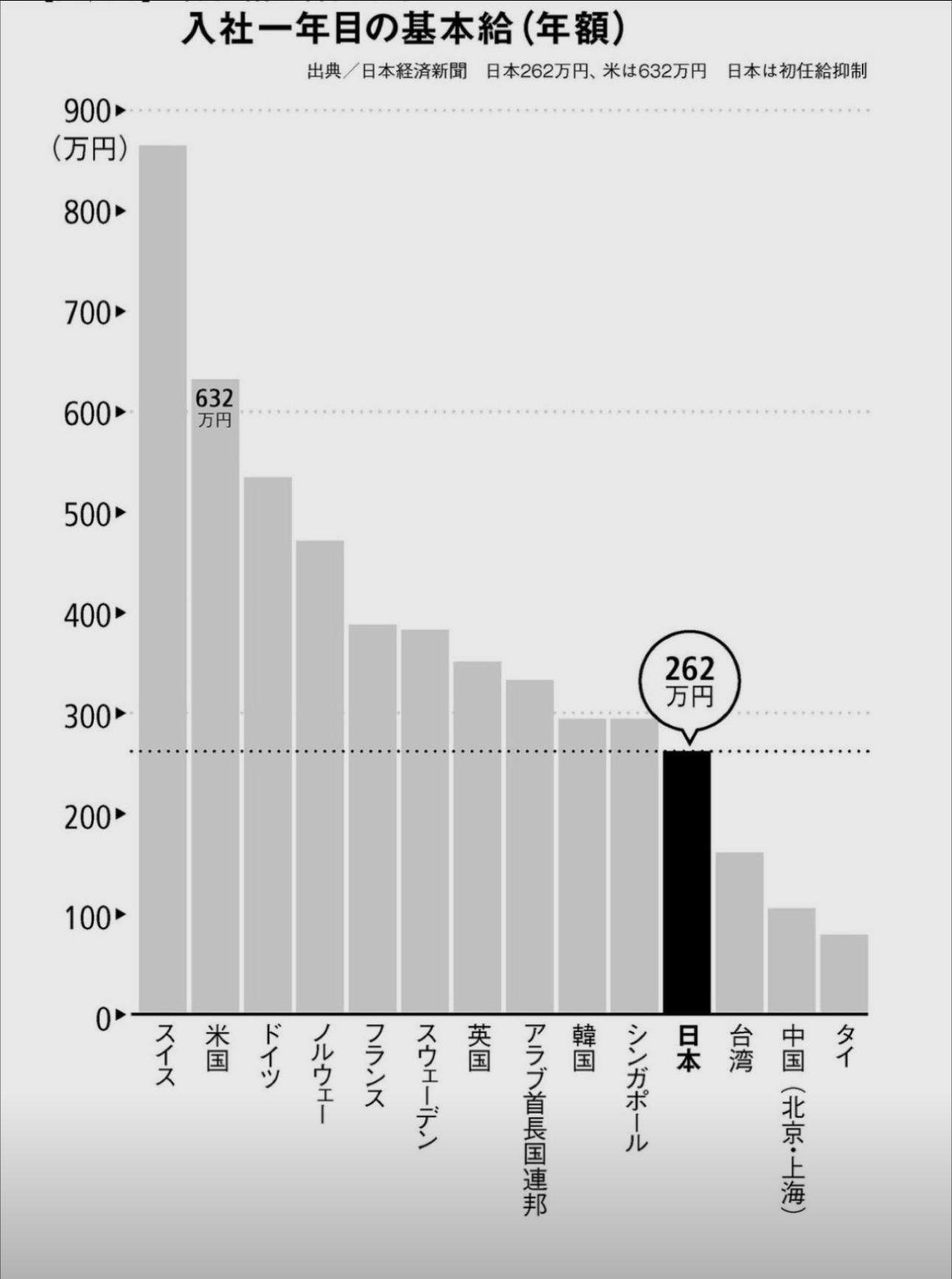

For instance, for an employee earning a monthly salary of 200,000 yen, the company must pay approximately 70,000 yen in social insurance premiums. If the salary is about 300,000 yen, this payment rises to nearly 100,000 yen.

Furthermore, the calculation of consumption tax doesn’t allow for salary expenses to be deducted. This means that as salaries increase, so does the consumption tax burden on the company.

The hefty social insurance premiums and consumption tax are significantly hindering Japan’s economic growth. While the Japanese government imposes economic sanctions on Russia, ironically, it’s also inadvertently applying a form of economic sanction on its own people.

Despite the renowned diligence, honesty, excellence, sincerity, earnestness, kindness, cleanliness, and hardworking nature of the Japanese people, these policies cast a shadow over the future outlook of Japan’s economy. I fear that the current economic policies may lead to a bleak future for Japan’s economy.

#EconomicInsights #JapaneseWorkCulture #BusinessInJapan #FiscalPolicy #SocialInsurance #Taxation #EmployeeRewards #EndOfYearEconomy #EconomicOutlookJapan #BusinessLeadershipInJapan

#JapanEconomy #BusinessChallenges #YearEndReflections #EconomicPolicy #JapaneseCulture